- Introduction

- The Ritz Carlton Central Park

- LAN Business Class

- Exploring Central Chile

- The Grand Hyatt Santiago

- Exploring Easter Island

- Exploring Machu Pichu

This Grand Hyatt certainly lived up to it’s name. Although I had read many mixed reviews, I vouch for it as a great hotel and as an awesome value for 8,000 Hyatt points! It’s one of the more impressing buildings in the city and also returns to Travel & Leisure’s 500 Best Hotels. Impressed in every objective matter.

This Grand Hyatt certainly lived up to it’s name. Although I had read many mixed reviews, I vouch for it as a great hotel and as an awesome value for 8,000 Hyatt points! It’s one of the more impressing buildings in the city and also returns to Travel & Leisure’s 500 Best Hotels. Impressed in every objective matter.

It must be clerified, I’m an absolute sucker for great buildings. This is why The Grand Hyatt Santiago joins the Park Hyatt skyscrapers (Shanghai and Tokyo) in my top hotels of 2012. The Park Hyatt hotels are absolutely stunning in every way and are also just cool. While the Grand Hyatt Santiago isn’t nearly as stunning, it’s still cool. All the rooms go up the tall open cylinder of the building and doors look down into the lobby. Plus, it has great views of the Andes, weather permitting. Some complained about how old the rooms were, but I didn’t notice it in the standard club rooms. Either way, the rooms were huge, had enormous windows and felt like a Jr. Suite with the drop down.

My first impression of their service was great. They checked me in and came around the counter to give me, with two hands, the room key. They did the same thing at the Ritz Carlton back in NYC, but I guess the expectations weren’t set that high. They blew them away.

There are a few restaurants in the hotel that are highly ranked including a sushi restaurant. At night the lounge provided sushi from the restaurant and thought it was great. Maybe it’s just great because it’s free? No, it was high quality. Although the lounge wasn’t huge it provided a good breakfast and evening meal, including drinks. However, it’s not a big lounge and for the rest of the day there is pretty much nothing in there. That being said, it’s a great lounge.

Finally, the hotel is a category two and therefore only 8,000 points! That is a very good value of 8,000 points and for 10,000 you can get a club room with access to the lounge. Of course, if you’re a Diamond you’ll get access anyways but the lounge is totally worth it for a sushi lover. This many Hyatt points can be earned quickly in good promos or by simply transferring at a 1:1 ration from Chase Ultimate Rewards to Hyatt Gold Passport.

Would I stay here again? Of course, it’s only 10,000 points! Although I’m not in love with Santiago and the hotel is completely in the business district where there’s nothing to see, I’d do it again. This reasoning partly confirms a repeat visit to the Hyatt, since if I’m there again it’s probably on a stopover and I wouldn’t mind hiding in the hotel.

It’s a nice property… A great property for 10,000 points.

As far as free travel, there’s plenty of reasons to think that the game isn’t slowing down. Credit card bonuses just keep getting bigger, although they got a little tighter than the 2010 & 2011 matching other people’s bonuses. Thus I still plan on earning the majority of my miles from credit card sign up bonuses although I have pretty much every travel credit card that exists… Again, I predict more targeted offers and higher spend requirements but certainly not smaller bonus offers – the competition is getting stiff.

As far as free travel, there’s plenty of reasons to think that the game isn’t slowing down. Credit card bonuses just keep getting bigger, although they got a little tighter than the 2010 & 2011 matching other people’s bonuses. Thus I still plan on earning the majority of my miles from credit card sign up bonuses although I have pretty much every travel credit card that exists… Again, I predict more targeted offers and higher spend requirements but certainly not smaller bonus offers – the competition is getting stiff.

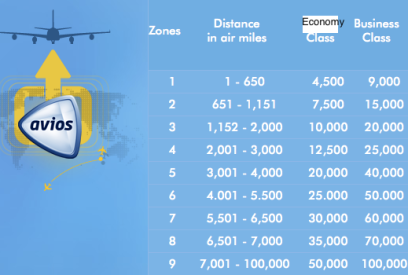

I mean look at the chart. If you’re flying 7,500 miles, isn’t it cheaper to take two 3,750 mile flights (for 20,000 miles each) than it is to take one 7,500 mile flight (for 50,000 miles)?

I mean look at the chart. If you’re flying 7,500 miles, isn’t it cheaper to take two 3,750 mile flights (for 20,000 miles each) than it is to take one 7,500 mile flight (for 50,000 miles)?